What is decentralized finance? Decentralized finance, also known as Defi, is a type of financial system built on blockchain technology, most commonly Ethereum, that reimagines financial transactions by doing away with middlemen. With Defi’s “smart contracts,” which execute financial transactions in certain circumstances, a variety of financial transactions are possible.

We’ll be talking about Defi now if you haven’t heard about Def., Defi stands for decentralized finance it is a very big and emerging industry in the crypto market and most people in crypto are very very excited and getting involved in Defi projects or Defi tokens.

So before we jump into those projects and tokens we have to do a quick rundown about what defy actually is.

What is Decentralized Finance or Defi?

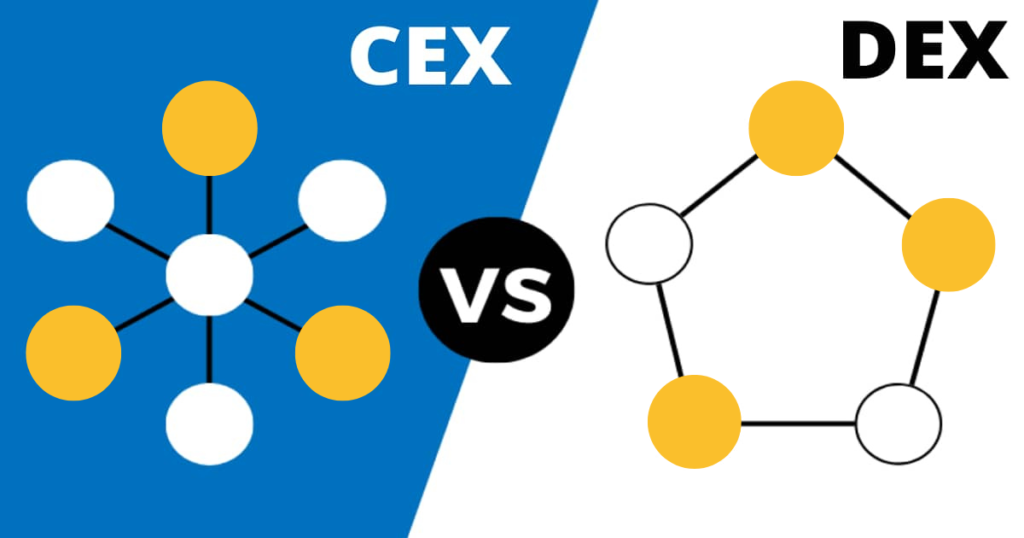

So normally you have centralized finance from your bank or loaning institutions and all sorts of financial services like that are centralized services. The bank is the centralization and the services that they offer. If you go to a loaning institution they are the centralized operation for handing out loans and handling interests and repayments and things like that.

Whereas decentralized finance is trying to challenge those traditional centralized methods of doing financial services by using smart contracts on usually the Ethereum blockchain, but also other blockchains. Smart contracts are able to replace these middlemen or centralized services such as banks and institutions and run it completely off a code that is very open source, can be checked by anyone that’s completely public, and can be audited by developers and things like that. Therefore it can be completely trusted to do the centralization services because its code it’s not really run by anyone, it’s just run by a piece of code, therefore, making it completely decentralized.

Example of a decentralized service Vs centralized service

Uni swap is a decentralized exchange basically instead of going to a massive exchange where there’s centralization such as finance or Bittrex or something like that instead, you can go to uni swap connects your Metamask wallet on your chrome browser or brave browser whatever browser you use on your computer. You don’t even have to make an account it just connects your Ethereum wallet to the website. It doesn’t ask you for any information about your personal information or anything like that. You can go on and start trading Ethereum erc20 tokens with Ethereum and other tokens and it’s completely decentralized. You’re working with a bit of code from uni swap to make it happen with other people out there in the world also trading.

There’s no middleman to take fees or try to freeze your account or request this and demand this. Now, of course, there are fees involved but the fees are then paid to yield farmers people anyone can take part in this part of it as well as provide liquidity to uni swap to allow the trades to happen and in return, they can earn a bit of yield on their liquidity provided in the terms of fees.

Related: Centralized vs Decentralized Exchanges | Best Exchange?

So therefore uni swap is a completely decentralized exchange. You’ve got people making trades and there’s a smart contract at the back end of it making it all work you have people providing liquidity to allow people to provide exchanges and the smart contract is intertwining all this together on the Ethereum blockchain it’s all open source it’s all trusted and audited by people you can go take a look yourself everything is completely transparent. And because there is no centralization this is the cool thing with Decentralized Finance. Another thing is because there’s no decentralization there is no holding back on stopping people from using it. Other examples of Defi projects are Pancake swap, sushi swap, etc.

What are the benefits of Defi?

Anyone in the world can use uni swap all they need is an internet connection some kind of Ethereum-based chrome or browser wallet such as Metamask connect it to uni swap with your internet connection on their computer with their wallet in their browser and they’re good to go. There’s nothing stopping them from saying you have to be this old, you have to be in this country, you have to submit your passport or anything like that, therefore it’s a completely decentralized service.

A service so therefore that is definitely a benefit as you can see here Defi apps are designed for a global audience anyone from the world around the world can take part in Defi platforms, all you really need is a smartphone or a laptop with internet access. So that’s really cool so the next thing is should you perhaps maybe look at investing in decentralized finance?

Should you invest in Defi?

Well, Defi projects because they’re quite out there there’s a lot of competition right now as well with Defi projects. Therefore there are a lot of cool new services that are upgrading on other services and it’s becoming a very competitive market. Now traditionally when you go have a look at coin market cap and see different Defi coins usually when people are looking to invest in a coin they’re trying to find a coin that actually has a use case, some kind of utility, or a team behind it needs to have something actually working behind it to make it valuable.

Now of course bitcoin was the first cryptocurrency therefore it’s kind of the mother of all cryptocurrencies. People kind of use bitcoin to access other cryptos which gives it a bit of an excuse. Ethereum on the other end Ethereum is enabling all these erc20 tokens and Defi to take place on its blockchain and it’s allowing developers to build apps and all sorts of things therefore Ethereum has a huge use case.

In the terms of uni swap, the uni swap token has huge use cases. As I said before you can provide liquidity on their platform and earn in fees. Usually, the fees are paid out in uni swap tokens. You can stake your uni swap tokens you can also use them as a governance token. There are so many use cases for the uni swap token.

Not only that but if you didn’t want to actually invest in a Defi token, instead you could actually invest in a blockchain that is looking at supporting Defi projects in the near future. A very good example is Cardano right now Ethereum is really the only one that is really out there with Defi projects and decentralized apps or decidualized financial apps or Defi apps, but because of Ethereum’s gas fees it was causing a lot of issues.

As you know Ethereum merge is just gonna take place so Ethereum will move to proof of stake then let’s see how uni swap will tackle this. Right now if you want to make a transaction with uni swap maybe you have to pay very very high fees as compared to other blockchain transactions, therefore we have projects like Cardano or ADA. They’re coming up and they are starting to compete with Ethereum and promise cheaper fees and all sorts and allowing projects from the Ethereum blockchain or Defi projects to simply move straight over to Cardano and offer their services on the cardinal blockchain as well. Therefore creating competition between these two coins when it comes to the use case for decentralized finance.

If you don’t want to actually just invest in a decentralized finance token like uni swap or chain link, instead you could actually look at a blockchain that is looking at creating and allowing Defi projects to take place using their blockchain on smart contracts and things like that such as Cardano.

Now another one is the polka dot as well you can also take a look at the polka dot if you want, these can get quite extensive when you start reading and get quite confusing but it’s good to do a bit of research and see what you think and feel about this.

Decentralized Finance seems to be the biggest hype at the moment in crypto and it could be for good reason it could really challenge traditional banking services such as banks and loaning institutions. pretty much traditional financial institutions could have a real competitor in the coming years not only that but also traditional crypto services like exchanges and things like that. Uni swap has already started to challenge some of these exchanges with the services that they’re offering.

The future of finances it’s very competitive decentralized open source everyone trusts it and can actually see what’s happening behind the scenes. It could really be part of the financial future and that’s why these coins are doing so well. If you actually have a look at the chart of any of these d5 coins or blockchains they have spiked up tremendously over the last couple of months in comparison to other tokens.

Related: Why Decentralized Exchanges are the future of crypto trading?

So my personal thoughts are if I was to invest in a Decentralized Finance project or a Defi coin token or even look at a blockchain that supports Defi and I want to actually buy some of that coin as well. I kind of do a bit more in-depth research and see the utility behind it see the possibilities and if I honestly think that this could become very mainstream a lot of people will adopt this Defi project or services for certain reasons, then perhaps I might buy some